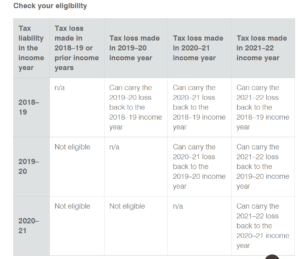

Loss carry back provides a refundable tax offset that eligible corporate entities can claim:

- after the end of their 2020–21 and 2021–22 income years

- in their 2020–21 and 2021–22 company tax returns.

Eligible entities get the offset by choosing to carry back losses to earlier years in which there were income tax liabilities. The offset effectively represents the tax the eligible entity would save if it was able to deduct the loss in the earlier year using the loss year tax rate. As it is a refundable tax offset, it may result in a cash refund, a reduced tax liability or a reduction of a debt owing to the ATO.

The Company tax return 2021 form will have the additional labels you will need to complete. The eligible entity does not need to amend the earlier income years to claim the offset, but you will need to lodge a form to claim the tax offset – refer to: https://www.ato.gov.au/uploadedFiles/Content/ITX/downloads/Loss_carry_back_claim_form.pdf

How to calculate the amount of tax offset

To calculate the amount of your tax offset for an income year follow these steps:

1. For each tax loss you are carrying back to an earlier income year

a. determine the amount of the tax loss you are carrying back

b. work out the net exempt income, that has not previously been used, in that earlier income year

c. subtract the amount at step 1b from the amount at step 1a

d. multiply the result from step 1c by your tax rate for the income year in which you made the loss.

2. If more than one tax loss is being carried back to the same earlier income year, add the step 1d results together. The amount you can claim is capped at the amount of your income tax liability for that earlier income year.

3. If you are carrying back losses to more than one earlier income year, apply steps 1 and 2 for all years the losses are being carried back to and add the results together.

4. If the amount calculated under step 3 is greater than your franking account surplus at the end of the income year in which you are claiming the tax offset, your offset is limited to your franking account surplus. Otherwise, the amount of your tax offset is the amount calculated under step 3. Note: step 4 does not apply to foreign residents (other than New Zealand franking companies).

Please refer more information and examples on ATO website https://www.ato.gov.au/Business/Loss-carry-back-tax-offset/#Claimingthetaxoffset

Or contact us phone us on 08 8410 8999 during our operating hours to discuss your situation.